How tech is dominating our lives?

The routine for most of us no matter what age… you get up and check your Whatsapp messages – the good morning messages on the groups – friends, family, colony group. Then comes emails, followed by some Facebook updates, then there are some notifications on news while you were sleeping, followed by Twitter updates. You then decide to check the calendar for the meetings lined up. You are also a little sleepy because you watched two episodes of your favorite show online on Netflix.

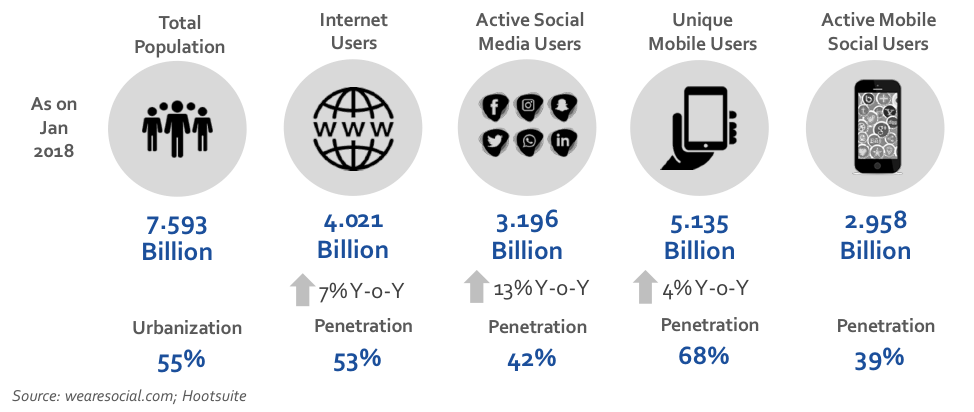

We are consuming data at an exponential rate

Today people have access to over 1.2 million terabytes of data right at their fingertips. India has increased its consumption of data by over 15 times in the past 3 years. From 2014 to 2017, the average data consumed by a person has increased from 0.26 GB to over 4 GB. This is an economy which is 1/6th of the world’s population. This is trend not just in India…

The dependency on technology has increased exponentially for you and even more for the next generation. The millennials wouldn’t even know how to use a physical map or communicate without an emoji! Even without the facts above you already intuitively know this; but have you ever thought how you can own a piece of this action? Many of these companies are listed and Indian citizens can now own these stocks.

Yes, you can invest in companies, whose services and products you are consuming. You are no longer bound by geography. Indian investors now have the opportunity to seek offshore equities and increase their global footprint. With rapidly growing markets and attractive returns on foreign equity, Indians are seeking diversification in their portfolios and adding their skin to the global game.

What do the returns look like on these Tech Investments?

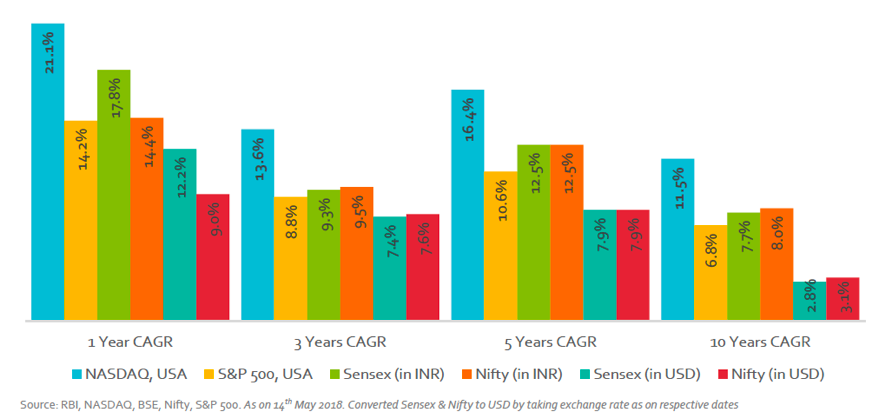

NASDAQ is the American stock exchange where most of the top technology companies are listed. Over the last decade, the NASDAQ has continued to outperform the Sensex and Nifty (which is even more stark after accounting for the depreciation of the INR). Just over the last year, the NASDAQ had outperformed Sensex by almost 9% and Nifty by over 12%. NASDAQ has continued to provide stronger returns over a ten-year period beating the Sensex and Nifty by a whooping CAGR of 8-9%.

Markets like the United States of America (USA) and China offer exposure to companies at the forefront of innovation and technology that are not available domestically – Facebook, Amazon, Google, Netflix, Tencent, Alibaba and many more…

Other reasons for Indians to buy USD denominated assets

A large part of an Indian citizen’s spending is linked to the US Dollar (USD). Right from the big ticket overseas education or holidays to our day to day expenses like petrol, gold, phones and other white goods.

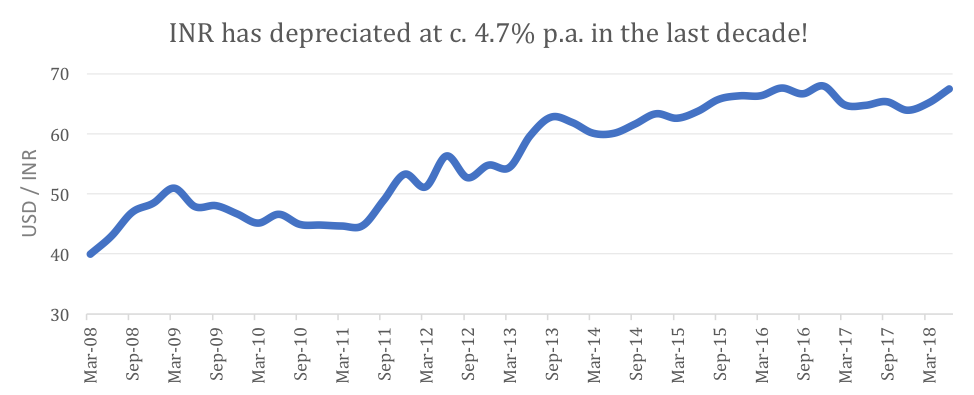

USD has remained the gold standard for trading on a global scale with over 50% of USD held in foreign reserves held by banks around the world. One should obtain USD assets for USD liabilities. Alongside, they also generate a natural hedge against the depreciating Indian Rupee (INR).

The Rupee effect – a double whammy:

In line with the long-term trend, since the beginning of 2018, the rupee has suffered more than 6% depreciation against the Dollar. India has not seen a surplus in the current account deficit (CAD) for over 15 years and it is fair to assume that INR will maintain its long-term depreciation trend against the USD (a requirement to maintain parity in real rates).

Investors have started looking at investing in international equities and diversify their holdings – make strategic long-term investments. Global investments provide investors the best of both developed and emerging markets, and more importantly the ability to diversify their risks. They are no longer bound by geography and can now create a centralized global portfolio. In addition, citizens can now adjust their financial goals for the next generation of “global citizens”.

At MCube Wealth Partners, we notice an inherent need for international equity in one’s portfolio.