2023: A Year of Global Challenges and Regional Disparities

2023 was marked by significant geopolitical tensions – 2 major conflicts with their ripple effect on global supply chains and security. Added to this was a slowdown in global growth with continued pressure to tame inflation.

While Europe struggled in the whole of 2023, by the second half of the year the stress in China forced the government to implement stimulus measures. The US showed great resilience and closer home, India also performed favourably.

Starting with the US: A strong labour market helped regulators to tame inflation

The US FED to curb inflation, implemented a series of interest rate hikes throughout 2023 – the Fed January 2023 rate of 4.5% peaked to 5.5% in July 2023. As a result, inflation which had reached a peak of 6.45% in January reduced to 3.24% by October (though still above the target rate of 2%). The FED maintained the Fed funds rate at 5.25%-5.5% during its December 2023 meeting, consistent with expectations. After peaking in October, bond yields have shown a declining trend, potentially indicating a pause in the rate hike cycle. Minutes from the Federal Open Market Committee’s latest policy meeting revealed policymakers anticipate rates to end next year within a range of 4.5%-4.75%, down from the current 5.25%-5.5%.

The first half of 2023 saw economic growth facing stiff headwinds, with GDP hovering around a modest 2.2%. This subdued performance reflected the impact of the FED’s tightening policies. The third quarter witnessed a stunning turnaround with GDP surging to a robust 5.2%. This unexpected resilience demonstrated the underlying strength of the US economy. The Annual CPI was 3.4% in December, up from a five-month low of 3.1% in November. The Fed released new projections, forecasting higher GDP growth for this year (2.6% vs. 2.1% in the September projection) but a slight dip in 2024 (1.4% vs. 1.5%).

Manufacturing Production in the US increased 1.2% year-on-year in December 2023, the first increase since January and the biggest since October 2022. Services PMI was revised slightly higher to 51.4 in December 2023 from a preliminary of 51.3, pointing to the strongest growth in the services sector in five months. The faster upturn in output stemmed from stronger demand conditions as new orders rose at the sharpest rate since June.

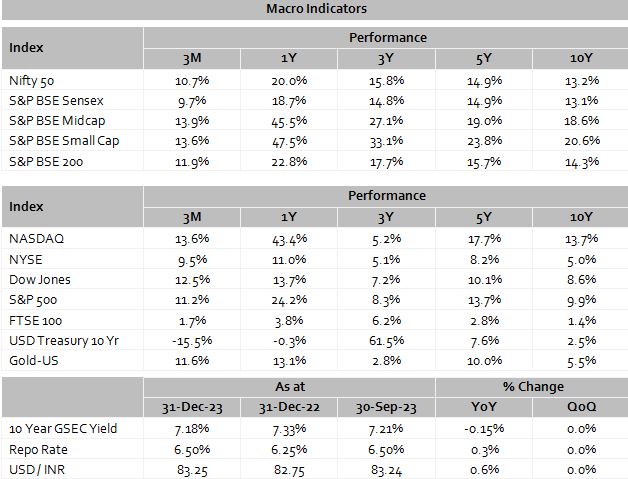

Despite the initial anxieties, the equity market navigated the choppy waters with remarkable success. US equities recorded substantial gains in the final quarter, propelled by expectations of impending interest rate cuts. The S&P 500 closed the year just below its early 2022 record high. Sectors most sensitive to interest rates, such as Information Technology, Consumer Discretionary, and Real Estate, outperformed. Conversely, the energy sector reported negative returns, influenced by weaker crude oil prices.

Europe: Facing the repercussion of being in the epicenter of global tensions

Higher interest rates exerted pressure on the Eurozone economy, leading to a 0.1% contraction in GDP in the second quarter of 2023, marking the first downturn since 2020. The flash Eurozone PMI fell to 47.0 in December, indicating a likely contraction in the region’s economy for Q4. Notably, Germany’s GDP shrank by 0.1%, Italy stalled, and France and Spain experienced modest growth (0.1% and 0.3%, respectively).

The European Central Bank is expecting a 0.7% growth in the Euro Area in 2023, influenced by tightened financing conditions and high prices and is projecting a growth of 1% in 2024. Inflation in the Euro Area rose to 2.9% (preliminary estimate) year-on-year in December 2023, up from a two-year low of 2.4% in November but slightly below the market consensus of 3%. This uptick, the first since April, was primarily driven by energy- related base effects.

The ECB in its second consecutive meeting, maintained interest rates at multi-year highs and hinted at an early conclusion to its remaining bond purchase scheme, all part of the strategy to combat high inflation. The main refinancing operations rate remained unchanged at 4.5% since September.

Despite economic challenges, the final quarter proved robust for Eurozone shares, buoyed by expectations of no further interest rate hikes. Softened inflation figures in both the Eurozone and the US fuelled optimism that interest rates might have peaked. The MSCI EMU index surged by 7.8%, with top-performing sectors being real estate and information technology, while healthcare and energy lagged, registering negative returns.

China: Stimulating Growth

China’s economy faced challenges in 2023, grappling with a sluggish recovery from Covid Zero policies and an escalating property crisis. In Q3 of 2023, China’s economy exhibited a seasonally adjusted growth of 1.3%, a notable acceleration from the downwardly revised 0.5% increase in Q2. This marked the fifth consecutive quarter of expansion, attributed to various monetary stimulus measures, including interest rate cuts. However, the property sector remained a hindrance as major developers faced significant defaults.

Consumer prices in China fell by 0.3% year-over-year in December 2023, extending a three-month decline—the longest streak since October 2009. Producer prices also contracted by 2.7% yearly in December 2023. On the positive side, exports from China surged by 2.3% year-on-year to a 15-month high of USD 303.6 billion in December 2023, signalling a recovery in global trade for the second consecutive month.

To bolster fragile economic growth, the central bank injected a substantial amount of medium-term policy loans and maintaining unchanged interest rates. In December, the People’s Bank of China (PBOC) injected a net $112.22 billion of fresh funds through medium-term lending facility (MLF) loans, marking the largest monthly increase on record. Economists anticipate China will maintain an accommodative monetary stance and potentially implement additional stimulus measures, including interest rate cuts to foster economic growth in the coming year.

India: Emerging as a new Global opportunity

In Q3 2023, the Indian economy exceeded expectations, expanding by 7.6% year-on-year, surpassing forecasts, and the Reserve Bank of India’s projection of 6.5%. Key sectors, including Agriculture, Manufacturing, and Construction, recorded robust growth rates of 1.2%, 13.9%, and 13.2%, respectively.

RBI maintained its policy repo rate at 6.5% for the fifth consecutive meeting in December 2023, aiming to keep inflation within the 2-6% target range while supporting growth. The RBI revised the economic growth forecast for fiscal year 2024 to 7% from 6.5% and maintained its inflation projection for the current fiscal year at 5.4%.

Annual inflation in India stood at 5.69% in December 2023, below market forecasts but the highest in four months, driven by a rise in food inflation to 9.5%. A lower-than-average monsoon rainfall impacted agricultural poduction. The Services PMI rose to 59.0 in December, the strongest reading since September, reflecting positive economic conditions. The Composite PMI reached 58.5, the highest since September, driven by faster growth in the service sector. Unemployment rate decreased to 8.65% in December, the overall average remained at 8.22% from 2018 until 2023.

Indian equity performed exceptionally well throughout the year, reaching new highs due to strong fundamental earnings and supportive government policies, particularly in infrastructure and sectors such as Défense, Power and Railways amongst others. FII’s Assets Under Management hit a record high in December 2023 after struggling to cross the previous mark for nearly two years. IPO market thrived, with 58 IPOs collectively raising over Rs53,000 crore. India’s gold reserves increased to 803.58 Tonnes in Q4 2023, reaching an all-time high. These factors are resulting in a Goldilocks effect in India.

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries