The first quarter of 2022 has been perhaps one of the most uncertain quarters in the last decade driven by (1) the Russia Ukrain conflict (energy and food supply disruption); (2) Rising global inflation; and (3) Slowdown in China (zero covid policy). The above factors resulted in correction in prices of financial assets – both bonds and equities and also a marked rise in commodity prices.

There are new worry points emerging, in particular valuation of private assets including start-ups, unlisted equities and art.

Starting with the US: Inflation pushed to a new four-decade high

Inflation soared to 8.5%, its fastest pace in more than four decades. Prices have been driven up by supply chain bottlenecks, robust consumer demand and disruptions to global food and energy markets. On the positive side unemployment rate is at a record low. The US posted its 11th consecutive month of 400,000-plus job gains, with the labour force now just 174,000 below the pre-pandemic level. The receding of the pandemic has resulted in employers going on a hiring spree with the leading sectors being leisure and hospitality, followed by professional and business services. Consequently, unemployment rate fell from 3.8% to 3.6%, the lowest level since the pandemic. Over the past 12 months, average hourly earnings have increased by 5.6% (while this rise represents strong growth, it is still below the rate of inflation of 8.5%).

On the back of rising inflation, the Federal Reserve is positioned to raise interest rates by atleast 50 basis points in May. Policymakers have rallied around a plan to as soon as next month to reduce the Fed’s holdings of Treasury bonds by up to $60 billion per month and its Mortgage Backed Securities holdings by up to $35 billion per month. The Feds balance sheet currently stands at nearly $9 trillion and the size of this balance sheet reduction of $95 billion a month is significantly larger than the start of the previous balance sheet reduction program in 2018. Federal Reserve in March approved its first interest rate increase, a quarter percentage point, in more than three years. Along with the rate hike, the committee also pencilled in increases at each of the six remaining meetings this year, pointing to a consensus funds rate of 1.9% by year’s end. That is a full percentage point higher than indicated in December.

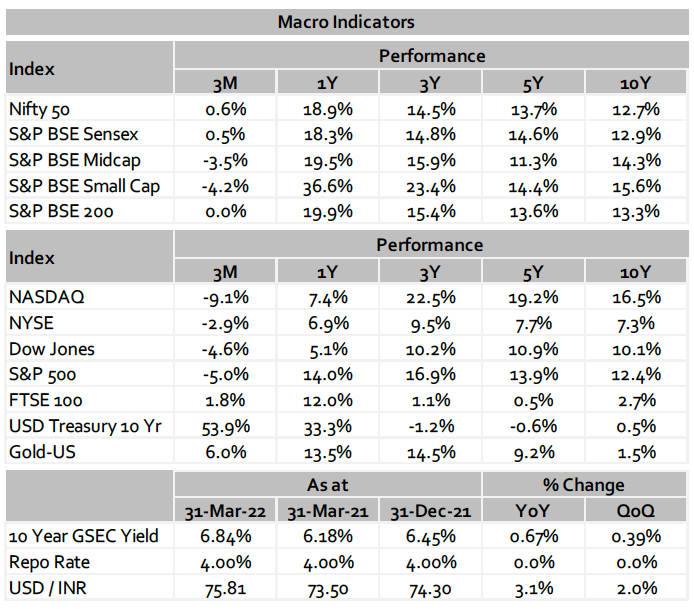

Wrapping up the markets, U.S. stocks experienced the first quarterly decline since the onset of the Covid pandemic in Q1’20. Rise in rates has had the greatest negative impact on long-duration Growth stocks. Nasdaq-100 (-10.1%) and Nasdaq Composite (-10.2%) registered the largest declines YTD. Ten out of 11 sectors finished in the red in Q1. Energy and utility companies were amongst the strongest performers in relative terms over the month, outperforming a falling market with modest gains. Technology, communication services, and consumer discretionary were amongst the weakest sectors.

Europe: Eurozone crisis as inflation soars to ‘brutal’ new high

Inflation rose to 7.5% in March, up from 5.9% in February. Energy has continued to be the dominant driver with inflation in prices now at 44.7% compared to 32% the month before. Prices for food, alcohol and tobacco also increased as costs increasingly rippled down the supply chain. The war in Ukraine and the ensuing economic sanctions imposed on Russia will cause far bigger shifts for Europe’s economy and markets. European leaders have been forced to rapidly accelerate plans to reduce their outsized dependence on Russian energy.

The eurozone economy is expected to expand 2.9% this year and 2.3% next year, down from 3.8% and 2.5% predicted a month ago. Growth forecasts for 2022 in Germany, Europe’s largest economy, were nearly halved to 2.2% from 4.0% in the previous quarterly poll in January. Expected growth in France and Italy was downgraded to 3.2% and 2.8% from 3.7% and 4.2%, respectively.

With unemployment at a low of 6.8% the ECB looks set to end its asset purchases this year and raise rates for the first time in well over a decade. The central bank will slow bond-buying to €30 billion ($33 billion) in May, to €20 billion ($22 billion) in June and the program could be halted as soon as the third quarter. The size of the ECB’s balance sheet has increased by a staggering €4 trillion ($4.4 trillion), including €1.85 trillion ($2.0 trillion) under its Pandemic Emergency Purchasing Program.

China: Covid lockdown déjà vu

China’s consumer price index (CPI) rose 1.5% year on year in March, driven by the rising cost of global commodities as well as epidemic outbreaks. Food prices fell by 1.5% year on year in March, compared with a drop of 3.9% in February, contributing to a 0.28% decline in the CPI. On the jobs report side, the country’s overall unemployment rate remains stable, fluctuating between 5% and 5.5% in recent months.

In the final month of the quarter, China’s manufacturing activity slumped to a two-year low due to disruptions caused by tech hub Shenzhen (which oversees roughly half of all China’s online retail exporters) going under a one-week lockdown, as well as cancelled export orders amid the uncertainty from Russia’s invasion of Ukraine. A spate of lockdowns in Shanghai and other Chinese cities is piling severe pressure on transport and logistics across the country, exacerbating the economic fallout of the government’s commitment to its zero-Covid policies as cases continue to soar to record levels. Chinese export growth slowed to an annual 15% in March, from 16% in January and February combined.

Yields on China’s 10-year government bonds fell below US Treasury yields for the first time in 12 years on expectations of more Chinese monetary easing. This will further sharpen the divergence in policy from the major global economies of the United States and Europe.

Closer home in India: Similar to last quarter the year begins on a flattish note

Equity markets began the year with a flattish movement and closed this quarter with Nifty rising 0.6%. Just when things were opening up, geopolitics began to dominate the narrative. Brent Crude crossed $130 per barrel in March and retraced sharply thereafter but continues to stay above the $100 mark. The spiking commodity prices coupled with rising rates by the Fed will keep the markets in check.

On the domestic macro front, the retail inflation rate in India – measured by the CPI, stood at 6.07% in Feb 2022. The retail fuel prices which were held steady for four months before March amid a global crude surge, have now started moving up after the elections and will further add to inflation pressures. Further, India’s Current Account Deficit (CAD) widened to USD 23Bn, 2.7% of GDP, in the 3rd quarter ending Dec 2021, the highest in 9 years. The RBI decided to keep policy rates unchanged yet again. However, it has done a complete U-turn by refocusing its attention on ‘run-away’ inflation, pivoting from its earlier growth-focused stance. The bond markets saw a material sell off across the curve with the benchmark 10-year G-Page | 3

Sec crossing the psychological 7% mark. Both equity and bond markets are expected to remain choppy and may offer opportunities to accumulate.

—————————————————————————————————————————————————————————————————————————————————————————————-

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries/